The cost for Wisconsin domestic LLCs is $25, and the cost for foreign LLCs is $80. You will have plenty of time to obtain the paperwork and either submit the information online or by mail. You can initially obtain this document from your registered agent, who will receive the hard copy of the paperwork prior to the deadline. If you are a foreign Wisconsin LLC, then you will have to submit the annual report by mail.

Dfi wisconsin non stock annual report file how to#

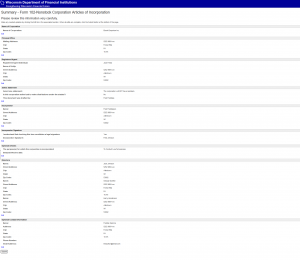

How to File the Annual ReportĪs previously noted, if you operate as a domestic LLC, you can simply visit the Wisconsin DFI website to submit your annual report or mail it in if you choose. It is primarily used for tax purposes, to ensure that all business information is up-to-date, particularly for ongoing tax legal and regulatory requirements.

The annual report updates important business information, such as the members’ names and/or addresses, the business and/or mailing address, and the registered agent information. However, foreign LLCs must send in their annual report by mail. You can file your annual report either by mail or online via the state’s Department of Financial Institutions (DFI) website. The annual report forms will be sent to your LLC’s registered agent prior to the deadline for filing. Therefore, entities that expect to have continuing operations should take steps to ensure their annual reports are timely filed, to reduce the risk of personal liability to its owners.The Wisconsin LLC annual report is required for all Wisconsin LLCs, both domestic and foreign. Inadvertent administrative dissolution could result in personal liability for any acts taken by or on behalf of the entity after dissolution, if such acts are other than to wind up and liquidate.

Dfi wisconsin non stock annual report file plus#

To bring the entity back, the entity must file a current annual report and pay the required filing fee, plus pay the fee for each prior year an annual report had not been filed.Ī dissolved entity (regardless of the reason for dissolution) generally continues its legal existence for some time but may not carry on any business except that which is appropriate to wind up and liquidate its business. Once an entity is dissolved, it may be possible to bring the entity back to active status with DFI later, but the costs may be higher than staying current with filings. The DFI periodically issues a Certificate of Administrative Dissolution list for such entities. If DFI does not receive the annual report within 60 days after the Notice publication, DFI may administratively dissolve the entity. If the mailing cannot be delivered, the entity name is published in a Notice of Administrative Dissolution. postal service at the registered agent’s address (one reason to ensure the registered agent and address is kept current with DFI). Prior to administrative dissolution, DFI attempts to contact delinquent entities by U.S.

An entity in delinquent status also may face challenges in bringing or defending a lawsuit.Įntities that remain in Delinquent Status too long are subject to being administratively dissolved. If a registered entity fails to submit its annual report and pay the filing fee timely, eventually DFI will place the entity in “Delinquent Status.” When in Delinquent Status, the entity will not be able to file any other documents with the Department until the entity is brought back to good standing by filing all past due and the current annual reports. postal service shortly before their annual reports are due, but an entity can check the status of its filing online at. Now LLPs likewise are subject to Wisconsin annual reports.ĭFI notifies registered entities by U.S. Historically, limited liability partnerships (LLPs) did not have to file annual reports in Wisconsin however that changed in 2016. In most other states, the filings are done with that state’s Secretary of State. In Wisconsin, most registered entities must file an annual report with the Wisconsin Department of Financial Institutions ( DFI). If your entity operates while administratively dissolved, the owners could have personal liability. Is your limited liability company, corporation, or other entity registered with the state delinquent? Not staying out past curfew or spraying graffiti on walls, but is it current with its annual report filing? If not, it could eventually be administratively dissolved. This article was updated on 7/ 9/ 2020 to clarify the potential limitations for an entity with a delinquent status.

0 kommentar(er)

0 kommentar(er)